Kotluy

6 Common Money Mistakes You Might Be Making (and How to Fix Them)

Even smart people make bad money decisions. Learn 6 common financial mistakes…

June 17, 2025

Whether you’re just starting your financial journey or looking to improve your money habits, the path to financial freedom starts with consistent and intentional actions. In this post, we’ll explore seven smart financial habits that can help you build wealth, reduce stress, and gain control over your money.

Budgeting is the foundation of financial health. Track your income, expenses, and savings goals each month. Use tools like Excel, Google Sheets, or budgeting apps such as YNAB or Mint.

💡 Tip: The 50/30/20 rule is a great starting point: 50% needs, 30% wants, 20% savings.

Life is unpredictable. A good rule of thumb is to have 3–6 months’ worth of expenses saved in a separate account. This fund helps you avoid debt in case of job loss, medical bills, or other unexpected events.

Focus on clearing debts with the highest interest rates, like credit cards or payday loans. This strategy, called the avalanche method, reduces the total interest you pay and helps you become debt-free faster.

Set up automatic transfers to a savings or investment account each time you get paid. “Paying yourself first” helps you save without thinking about it — and without the temptation to spend.

Start investing as early as possible to take advantage of compound interest. Even small, regular investments can grow significantly over time. Consider low-cost index funds or consult a financial advisor.

Your credit score affects your ability to get loans, credit cards, and even some jobs. Check your credit report regularly and dispute any errors. Aim for a score above 700 for favorable rates.

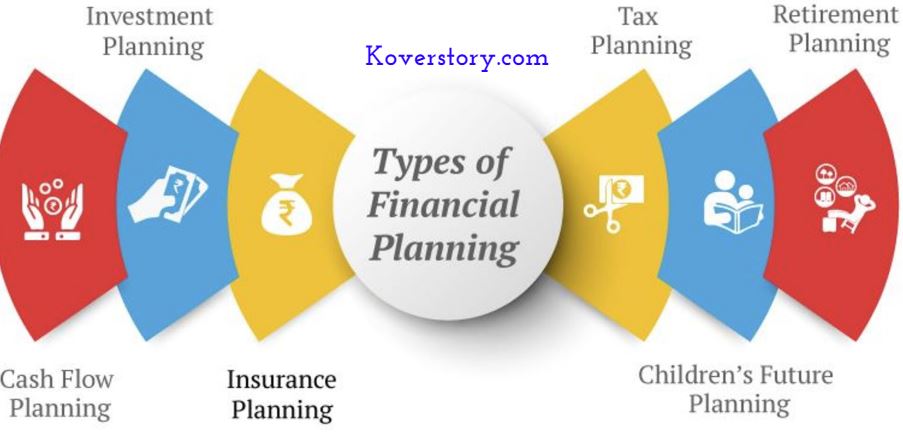

Stay informed about personal finance topics like budgeting, investing, taxes, and retirement planning. Read books, listen to podcasts, or follow trusted finance blogs.

📘 Recommended read: “The Psychology of Money” by Morgan Housel.

Financial freedom isn’t about earning the most money — it’s about making smart decisions with the money you have. Start with one or two of these habits, stay consistent, and watch your financial life transform over time.

💬 What financial habit has helped you the most? Share it in the comments!

📩 Subscribe to our newsletter for more personal finance tips every week!

Even smart people make bad money decisions. Learn 6 common financial mistakes…

Think saving money is impossible when your budget is tight? Think again….

Introduction Whether you’re just starting your financial journey or looking to improve…